Contemporary artists watching BSV tech platform and rate of Bitcoin’s adoption

As central CeFi banks First Republic and Silicone Valley go broke, JP Morgans silently buying & transferring old Cefi money to new Bitcoin DeFi

As central Cefi banks like First Republic and Silicone Valley go broke, the JP Morgans are silently buying up and transferring old Cefi money to new Bitcoin DeFi since people with money are in the know as to the shift to new Digital currencies game changer...soon. Bitcoin is on an augmented faster adoption trajectory than other groundbreaking technologies, even though mainstream news media makes no word of it.

According to former Google engineer Michael Levin, do not tell anyone.

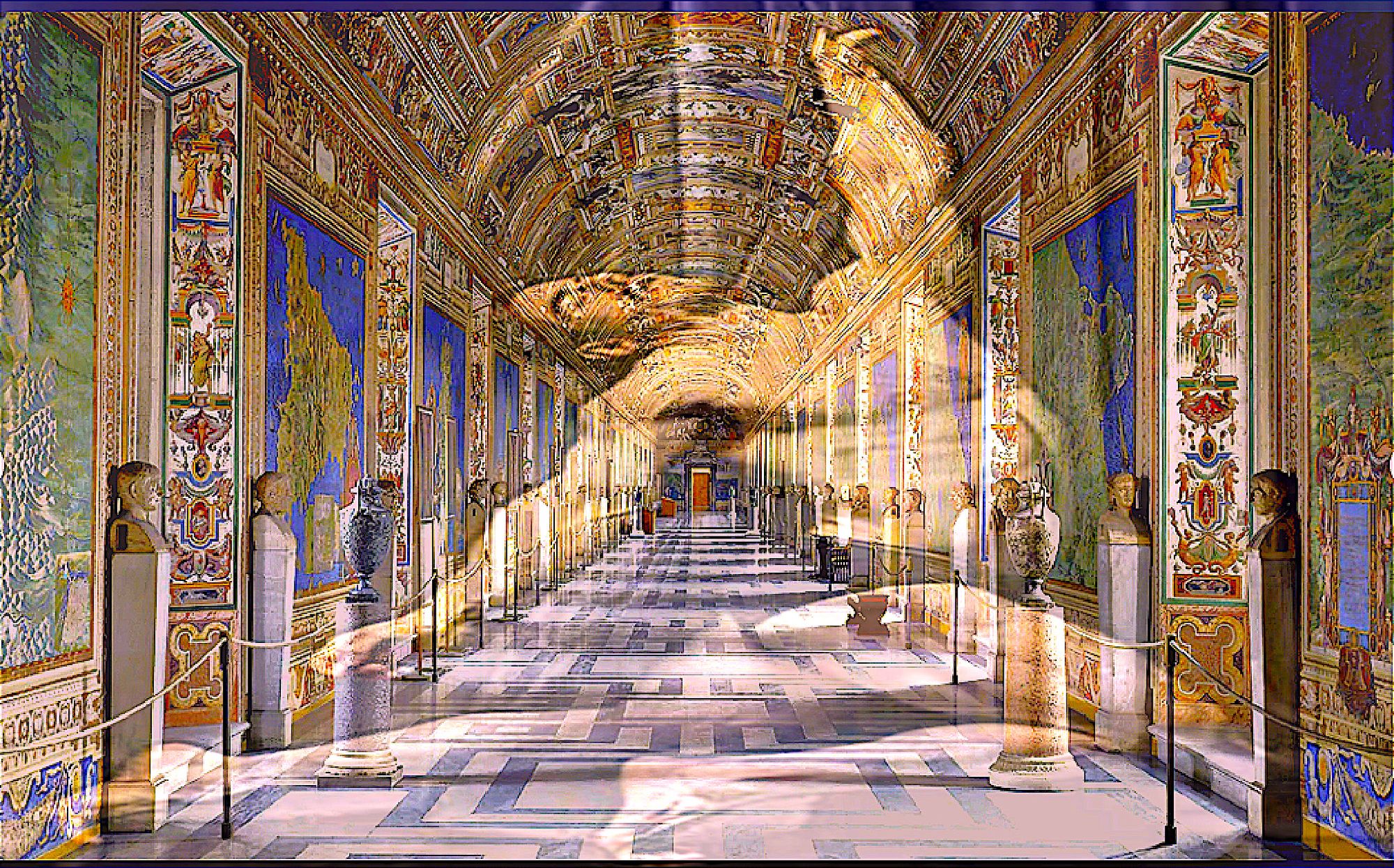

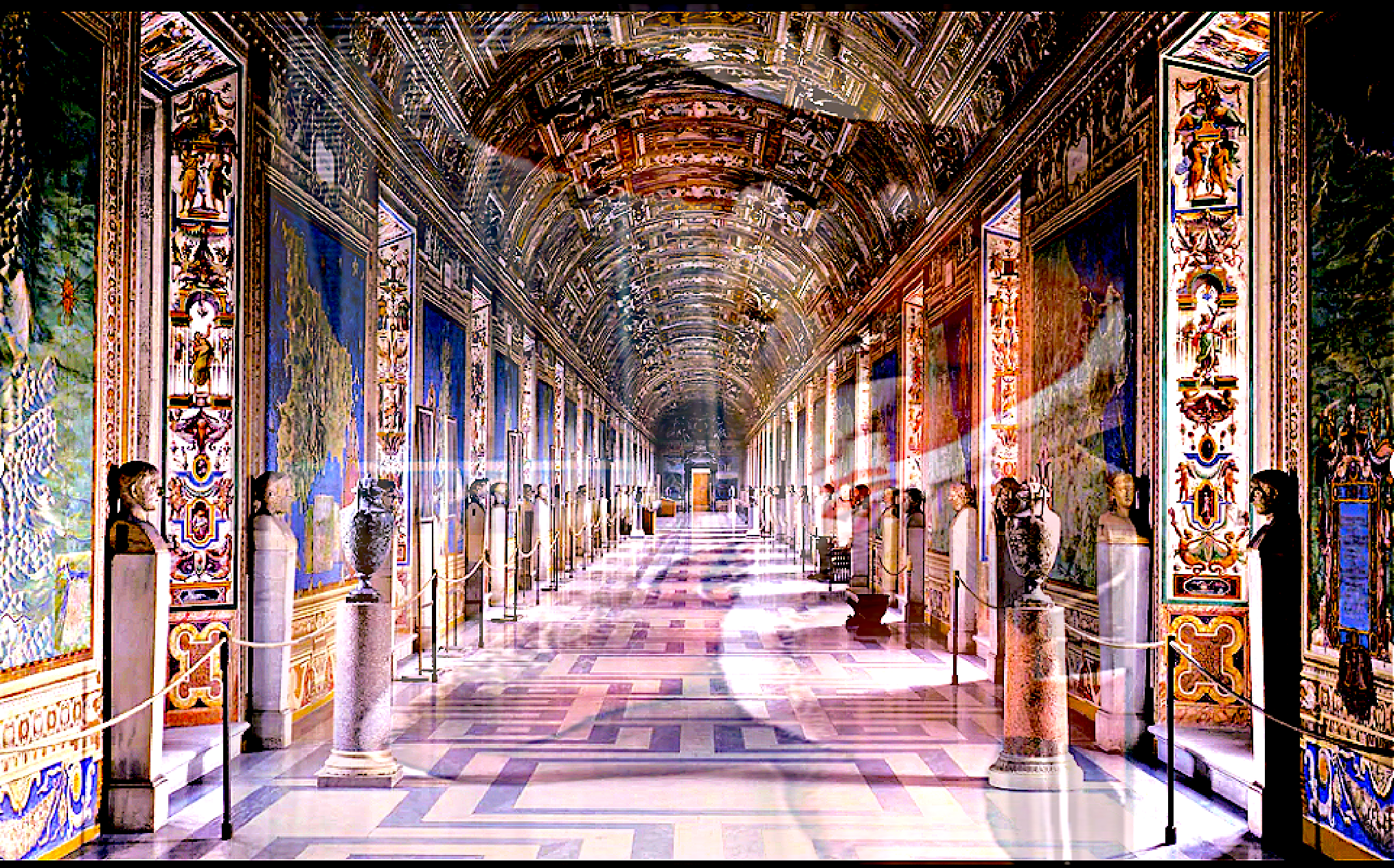

Bitcoin, the world's first peer-to-peer digital currency, has garnered significant attention and investment from entrepreneurs, investors, and businesses across the globe. Its meteoric rise in value in recent years, coupled with its projected adoption rate of reaching $500,000 by 2025. The contemporary crypto artist's community, represented by industry expert Claude Edwin Theriault, sees how it offers immense potential for impacting the future landscape of technology and global economic systems- like the walled garden art world market filled with forged documents and knock-off fake reproductions for centuries.

Built on innovative blockchain technology, Bitcoin provides trust, transparency, and decentralization—crucial elements sought after by businesses and individuals alike. Contemporary artists, for instance, are increasingly embracing NFTs (Non-Fungible Tokens) that leverage blockchain technology to protect the intellectual property of their creations, thereby mitigating the risks of counterfeiting and fraud and with an etherscan time stamp to the second, giving it irrefutable proof of ownership of the Intellectual property of its creator.

Significance of Bitcoin in the Future Technological Landscape

As a proof-of-work digital ledger, Bitcoin has significantly transformed how value is stored, transacted, and secured on the Internet. Blockchain technology, the backbone of Bitcoin, promises to disrupt not just the financial sector but also supply chain management, record-keeping systems, and data integrity across diverse industries. Consequently, investors and entrepreneurs now prioritize monitoring the adoption rate and progress of Bitcoin and blockchain technology as essential market indicators.

Role of Blockchain Technology in a Trust-Driven Environment

In an era where trust is the new currency, data security breaches, and opaque centralization are commonplace, blockchain technology's trust, transparency, and decentralization create unparalleled value. The secure, tamper-proof, and easily verifiable nature of blockchain data makes it an attractive option for businesses focusing on safeguarding sensitive information or ensuring accurate record-keeping.

Implications of Bitcoin's Projected Adoption Rate and Value

As the adoption of Bitcoin accelerates and its value reaches unprecedented heights, several implications for the global economic and financial systems are anticipated:

- Currency Competitiveness: Central banks and governments may be compelled to introduce alternative digital currencies or reconsider their monetary policies in the new multi-alt-coin DeFi world currency

- Financial Inclusion: Bitcoin may empower underserved bankless communities worldwide by providing them access to financial services and promoting financial loans for entrepreneurial development like never before.

- Institutional Investment: The increasing value of Bitcoin is likely to attract institutional investors and businesses, which may consider incorporating Bitcoin staking into their investment portfolios or reserves, gaining lucrative interest.

In conclusion, Bitcoin and the underlying blockchain technology can considerably reshape the technological landscape and global economic systems as the adoption rate gains momentum and reaches new heights predicted by experts such as Contemporary artist Claude Edwin Theriault of MBF-Lifestyle.

Who see how it is crucial for investors, entrepreneurs, and businesses to closely monitor the advancements in Bitcoin and prepare for inevitable transformative changes coming by the day. Despite mainstream media's relative silence on these matters, savvy professionals are well-advised to remain informed and adapt to the rapidly evolving digital landscape, as tech and Internet-savvy people did 25 years ago while mainstream news media slept.

FAQ:

How are contemporary artists utilizing BSV technology and Bitcoin?

Contemporary artists are leveraging BSV technology and Bitcoin's adoption to protect their intellectual property through NFTs, ensuring trust and transparency in their artistic transactions. This integration supports artists in safeguarding their creations from counterfeiting, with blockchain providing a secure and verifiable ownership record.

Why are contemporary artists interested in Bitcoin's adoption rate?

Artists are interested in Bitcoin's adoption because it influences the financial landscape, offering new opportunities to secure and transact value. As Bitcoin's adoption grows, it can empower artists financially, providing them access to innovative platforms like DeFi for managing and monetizing their works.

How might shifts to Bitcoin and DeFi impact artists in Canada?

The shift towards Bitcoin and DeFi could provide Canadian artists with broader access to global markets and alternative economic systems, enhancing their ability to reach international buyers and investors. This digital transformation offers financial inclusivity and a new way to engage with the art market.

What role does blockchain technology play for contemporary artists today?

Blockchain technology plays a crucial role for contemporary artists by offering a decentralized platform to certify authenticity and ownership of their artworks. This reduces fraudulent activity in the art world, providing artists with a reliable method to prove and maintain ownership of their creative output.

How does Bitcoin adoption relate to the future of the art market?

As Bitcoin adoption increases, it reshapes the art market by introducing new payment methods and investment opportunities, such as buying artworks with cryptocurrencies or investing in art-backed NFTs. This evolution creates a more dynamic, inclusive, and efficient market for both artists and collectors.

In what ways are artists benefiting from the integration of digital currencies into the art world?

Artists benefit from digital currencies by having more control over their financial transactions, reduced reliance on traditional financial systems, and the ability to reach a wider audience. Cryptocurrencies facilitate easier transactions and can potentially offer new streams of income through platforms like NFT marketplaces.

What is the significance of Bitcoin's projected growth for contemporary artists?

Bitcoin's projected growth signifies potential financial stability and investment opportunities for contemporary artists. As its value increases, Bitcoin can offer artists new ways to diversify their financial portfolio, fund their projects, and gain exposure to a global digital economy.